|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding the Differences Between Chapter 7 vs Chapter 13 Bankruptcy

Filing for bankruptcy can be a daunting decision, but understanding the differences between Chapter 7 and Chapter 13 bankruptcy can help you choose the right option for your financial situation.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is often referred to as 'liquidation bankruptcy.' It allows individuals to discharge most of their debts. Here's how it works:

Eligibility Requirements

- Means Test: Determines if your income is low enough to qualify.

- Credit Counseling: Must complete within 180 days before filing.

Process Overview

- File a petition with the bankruptcy court.

- Automatic stay goes into effect, stopping most collection actions.

- A trustee is appointed to oversee your case.

- Non-exempt assets may be sold to pay creditors.

- Debts are discharged in approximately 3-6 months.

For more personalized advice, consider consulting a bankruptcy attorney woodland hills ca for guidance.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as a 'wage earner's plan,' allows individuals to develop a repayment plan to pay back their debts over time.

Eligibility Requirements

- Regular Income: Must have a steady source of income.

- Debt Limits: Unsecured debts must be less than $419,275, and secured debts less than $1,257,850.

Process Overview

- File a petition and propose a repayment plan to the court.

- Automatic stay stops most collection actions.

- Plan approval by the court, with a typical duration of 3-5 years.

- Make regular payments to a trustee, who distributes funds to creditors.

- Remaining eligible debts are discharged upon plan completion.

Consulting a professional, such as a bankruptcy attorney worcester ma, can be beneficial in understanding your options.

Key Differences

The primary distinction between Chapter 7 and Chapter 13 bankruptcy lies in asset liquidation versus debt repayment. Chapter 7 may require selling assets, while Chapter 13 focuses on restructuring debt.

FAQ

What happens to my credit score after filing?

Filing for bankruptcy can significantly impact your credit score, but over time, with responsible financial behavior, you can rebuild your credit.

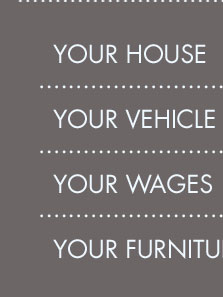

Can I keep my house if I file for bankruptcy?

In Chapter 13 bankruptcy, you may be able to keep your home if you continue making mortgage payments. In Chapter 7, it depends on the equity and state exemptions.

How long does bankruptcy stay on my credit report?

Chapter 7 bankruptcy remains on your credit report for 10 years, while Chapter 13 stays for 7 years.

Comments Section - Not everyone is eligible for a Chapter 7 (including high income debtors and repeat filers). - In states with bad exemptions, ...

The biggest differences between Chapter 7 and Chapter 13 bankruptcy are what happens to your property and who qualifies financially.

Chapter 7 bankruptcy "discharges" or erases qualifying debts, such as credit card balances, medical bills, and personal loans.

![]()